Need quick cash but tired of long bank queues and paperwork? Mobile loan apps like Cashbus Loan APK are changing how Nigerians borrow money. Promising fast approvals, easy applications, and zero collateral, Cashbus has become a buzzword among people looking for quick loans.

But what’s the real story behind this app? Is it safe? Does it truly deliver what it promises?

In this guide, we’ll look into Cashbus Loan Nigeria reviews, explore the services they offer, and help you decide if this loan app is worth your time or better avoided.

How to Get the App

Downloading the Cashbus loan app is a straightforward process for Android users.

To get started:

- Ensure your smartphone meets the basic requirements

- Visit the official app store

- Search for “Cashbus”

- Click “Install”

- Verify your device permissions

- Complete the initial setup process

Pro Tip: Always download from official sources to protect your personal information and ensure app security.

Read Next: 5 Trusted Loan Apps to Watch Out In 2025

Creating Your Account and Profile

The Cashbus loan login process is designed for maximum user convenience.

Here’s what you’ll need:

- Valid government-issued ID

- Proof of income

- Active phone number

- Bank account details

- Personal contact information

The registration typically takes just a few minutes, with the app guiding you through each step of verification and profile creation

Cashbus Loan App Application Process

The Cashbus loan application involves several critical steps for potential borrowers:

Preparation Requirements

- Android smartphone with sufficient memory

- Valid phone number linked to BVN

- Government-issued ID

- Active bank account

- Clear selfie for identity verification

Step-by-Step Application

1. Download and Install

- Get the app exclusively from Google Play Store

- Ensure your device meets basic requirements

2. Account Registration

- Register using your phone number

- Preferably use number connected to BVN

- One-time password (OTP) will be sent for verification

3. Information Submission

- Fill KYC information including:

- Residential address

- Next of kin details

- Employment information

- Biometric Verification Number (BVN)

4. Additional Verification

- Pay NGN 30 to bind ATM card

- Submit live selfie for identity confirmation

- Provide consent to access contacts and transaction records

5. Loan Evaluation

- App analyzes credit score

- Result displayed within two minutes

- Loan amount disbursed directly to bank account if approved

*Important Caution: The app requires extensive personal data access and has aggressive collection practices.

Read Next: Top 8 Easy Loan Apps in Nigeria

What Makes Cashbus Different (And Not in a Good Way)

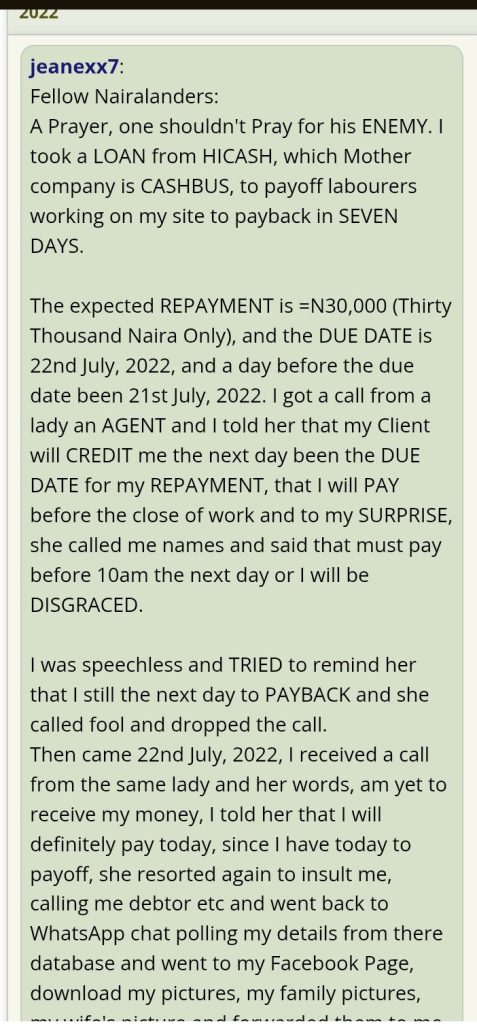

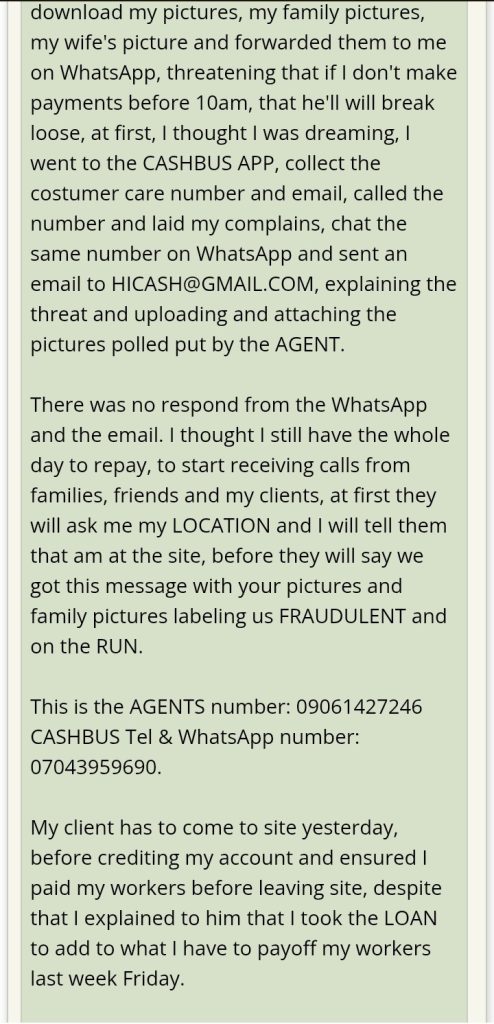

Unlike friendly, supportive loan apps, Cashbus loan Nigeria has developed a reputation for aggressive and threatening collection tactics. Their approach goes way beyond standard loan recovery we’re talking about:

- Sending terrifying messages to your contacts

- Threatening family members

- Posting fake “obituary” pictures

- Sending messages with extreme, life-threatening language

The Ugly Truth About Their Lending Practices

Interest Rates and Loan Terms:

- Interest Rate: Around 35%

- Loan Duration: As short as 7 days

- Typical Loan Amount: Between NGN 10,000 to NGN 200,000

Real User Experiences

Users have reported nightmare scenarios, including:

- Aggressive debt collection messages

- Threats sent to personal contacts

- Extreme language suggesting harm to borrowers

- Rapid escalation of debt through daily interest charges

How They Operate

Cashbus typically:

- Offers quick loan approvals

- Disburses partial loan amounts

- Charges high administrative fees

- Uses intimidation as a primary collection strategy

Red Flags to Watch Out For

Danger Signs:

- Threatening messages to contacts

- Extremely short repayment windows

- Daily interest rates of 5-7%

- Messages suggesting personal harm

Read Also: Loan Apps With Low-Interest Rates in Nigeria 2025

What Users Are Saying

Most forum discussions strongly recommend avoiding Cashbus completely. Users like jeanexx7 and GURUSBEST have shared traumatic experiences involving:

- Constant harassment

- Reputation damage

- Psychological stress

Protecting Yourself

Recommended Steps:

- Never borrow from unregulated apps

- Always read complete terms

- Verify the lending institution

- Have a solid repayment plan

- Use reputable, regulated lending platforms

Alternative Options

Instead of Cashbus, consider:

- PalmPay (mentioned as more user-friendly)

- Traditional bank loans

- Cooperative societies

- Family and friend networks

Legal and Ethical Considerations

These loan apps operate in a gray legal area. While they provide quick cash, their methods often cross ethical boundaries.

The Nigerian financial regulatory environment is still catching up with digital lending practices.

Frequently Asked Questions

While registered, their practices are highly questionable and potentially predatory.

Typically within minutes, but with extremely high hidden costs.

Basic ID, bank details, and personal information.

The regulatory framework is still developing, offering limited protection.

Conclusion

Cashbus Loan Apk stands out as one of Nigeria’s go-to platforms for fast, no-fuss loans. From instant approvals to flexible repayment terms, it’s clear why many users are giving it a try. But as with any financial service, it’s important to read the fine print, borrow wisely, and only take what you can comfortably pay back.

References

- loansharkreview.com– 9Cash Cashbus

- loansharkreview.com– Cashbus

- loansharkreview.com– Are These Loan Apps Safe (Cashbus)

- streetsofkante.com– Cashbus Loan App Review: APK download, customer care number